Asia’s Strategic Portfolio: How ASEAN is Turning Great-Power Rivalry into Opportunity

The Association of Southeast Asian Nations (ASEAN) has long been perceived as a “sandwich region,” caught between the strategic interests of the United States and China. This traditional viewpoint sees ASEAN as a passive arena where the dynamics of great-power rivalry play out, with member states pressured to align with one side or the other. However, as the Indo-Pacific becomes the epicenter of global competition, this narrative is evolving. ASEAN is increasingly demonstrating strategic agency, actively turning great-power rivalry into an avenue for growth, diversification, and diplomatic maneuvering. This article explores how ASEAN’s evolving strategy not only redefines its regional role but also presents fresh opportunities and challenges for European and German foreign policy and business interests.

ASEAN’s Evolving Role in a Multipolar Indo-Pacific

Southeast Asia’s economic resilience remains compelling. According to the Asian Development Bank and the World Economic Forum (WEF), ASEAN countries are projected to grow at an average of about 5% per year through 2030, making the region one of the world’s fastest-growing economic hubs. This growth is fueled by a combination of rising domestic consumption, robust infrastructure projects, and increasing integration within the region. Importantly, ASEAN has capitalized on global shifts in supply chains triggered by the US-China trade tensions and the COVID-19 pandemic. As companies seek to reduce dependency on China, countries such as the Philippines and Vietnam have emerged as preferred alternatives for manufacturing and assembly. For instance, the Philippines saw a 22% increase in foreign direct investment (FDI) in manufacturing in 2024, driven by government reforms, competitive labor costs, and improving logistics infrastructure.

Beyond traditional investments, ASEAN is attracting non-conventional capital flows, especially from Gulf state sovereign wealth funds. In 2024, Gulf investments into Southeast Asia reached approximately $15 billion, focusing on green technology, fintech, and infrastructure development. This growing inflow diversifies ASEAN’s economic partners and reinforces its role as a pivot point for global finance, enabling the region to leverage multiple sources of investment while balancing the influence of major powers. This strategy showcases ASEAN’s proactive approach to managing complexity by developing a broader strategic portfolio, rather than remaining constrained by Washington-Beijing rivalry.

Case Studies Illustrating Strategic Agency

The Philippines exemplifies ASEAN’s new strategy. By aggressively improving its business environment, upgrading ports and logistics, and enabling workforce development, the country has successfully attracted manufacturing relocations seeking alternatives to China. These developments have generated thousands of new jobs and positioned the Philippines as a competitive hub in global electronics and automotive supply chains.

Another relevant example is the notable increase in investments from Gulf sovereign wealth funds. These funds have supported high-impact projects in energy transition and digital infrastructure, helping Southeast Asia advance its sustainability goals while injecting fresh capital into the region. The presence of alternative investors strengthens ASEAN’s bargaining position on the global stage by offering options beyond traditional Western or Chinese funding.

Implications for Europe and Germany

The evolution of ASEAN’s agency compels a strategic rethink among European policymakers and business sectors, especially Germany’s SMEs that look to Asia for trade and investment opportunities. With ASEAN’s diversified economic landscape and openness to foreign partnerships, German companies can find fertile ground for expansion, innovation, and supply chain diversification beyond China.

German foreign policy should shift from viewing ASEAN as merely a buffer zone within US-China rivalry to recognizing the bloc’s own strategic ambitions and complex partnerships. This includes strengthening bilateral relations, engaging in ASEAN-led multilateral forums, and fostering cooperation in areas like sustainable development, technology, and education. In doing so, Germany can build trust and position itself as a reliable partner, while safeguarding its economic interests in an increasingly contested region.

Failure to adjust risks marginalizes Germany’s influence in Indo-Pacific affairs and limits SMEs’ ability to compete in Southeast Asia’s booming markets. Embracing ASEAN’s strategic portfolio enables Germany to diversify its economic ties and enhance its geopolitical relevance.

Navigating Constraints and Opportunities

Despite ASEAN’s growing agency, member states continue to face structural challenges, including economic dependencies and complex security ties, particularly with China and the US. Yet the region’s ability to balance competing interests, coupled with its expanding economic partnerships, gives it significant room for maneuver. ASEAN’s pursuit of a “third way,” marked by hedging and strategic diversification, reflects an intelligent recalibration in response to multipolar rivalry.

Conclusion: Towards a New European Engagement with ASEAN

ASEAN’s transformation from a passive zone of competition to an assertive actor underscores the region’s increasing importance on the global stage. For Germany and Europe, this shift requires a forward-looking approach that prioritizes ASEAN’s agency and the opportunities it presents. Recognizing ASEAN not merely as an extension of great-power rivalry but as a multifaceted regional actor offers pathways for sustainable economic collaboration, diplomatic engagement, and mutual prosperity. Germany’s engagement with ASEAN in this evolving context can serve as a model for European interaction in the Indo-Pacific, ensuring relevance and influence in an era defined by complexity and competition.

By capitalizing on ASEAN’s strategic portfolio, Europe stands to benefit from robust growth, diversified partnerships, and a stronger foothold in one of today’s most dynamic regions.

The World in Focus: Highlights from Foreign Affairs’ Best Books of 2025

2025: A World Without Resolution

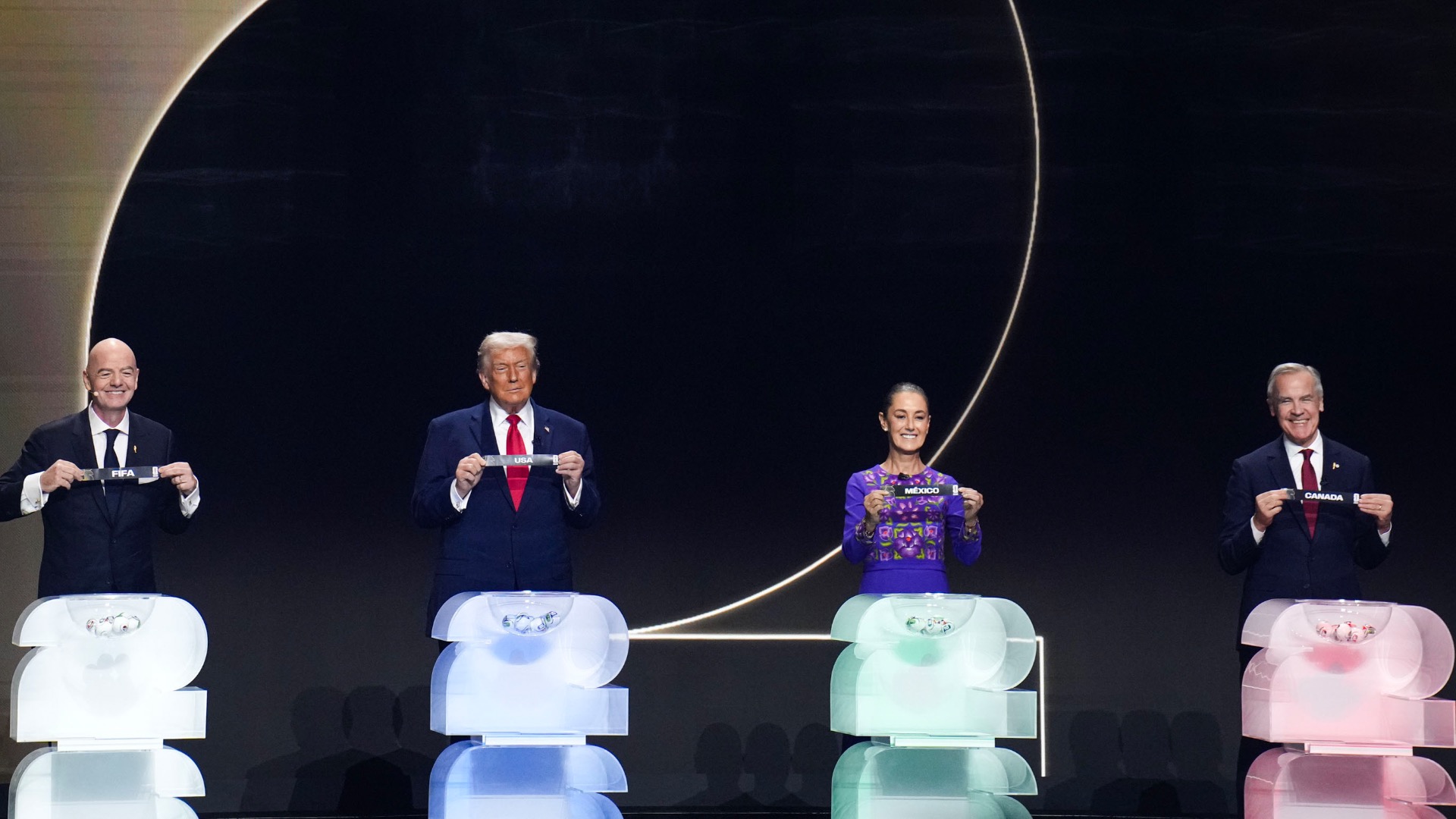

The U.S.-Venezuela Limited War of 2025: A Legal and Strategic Assessment