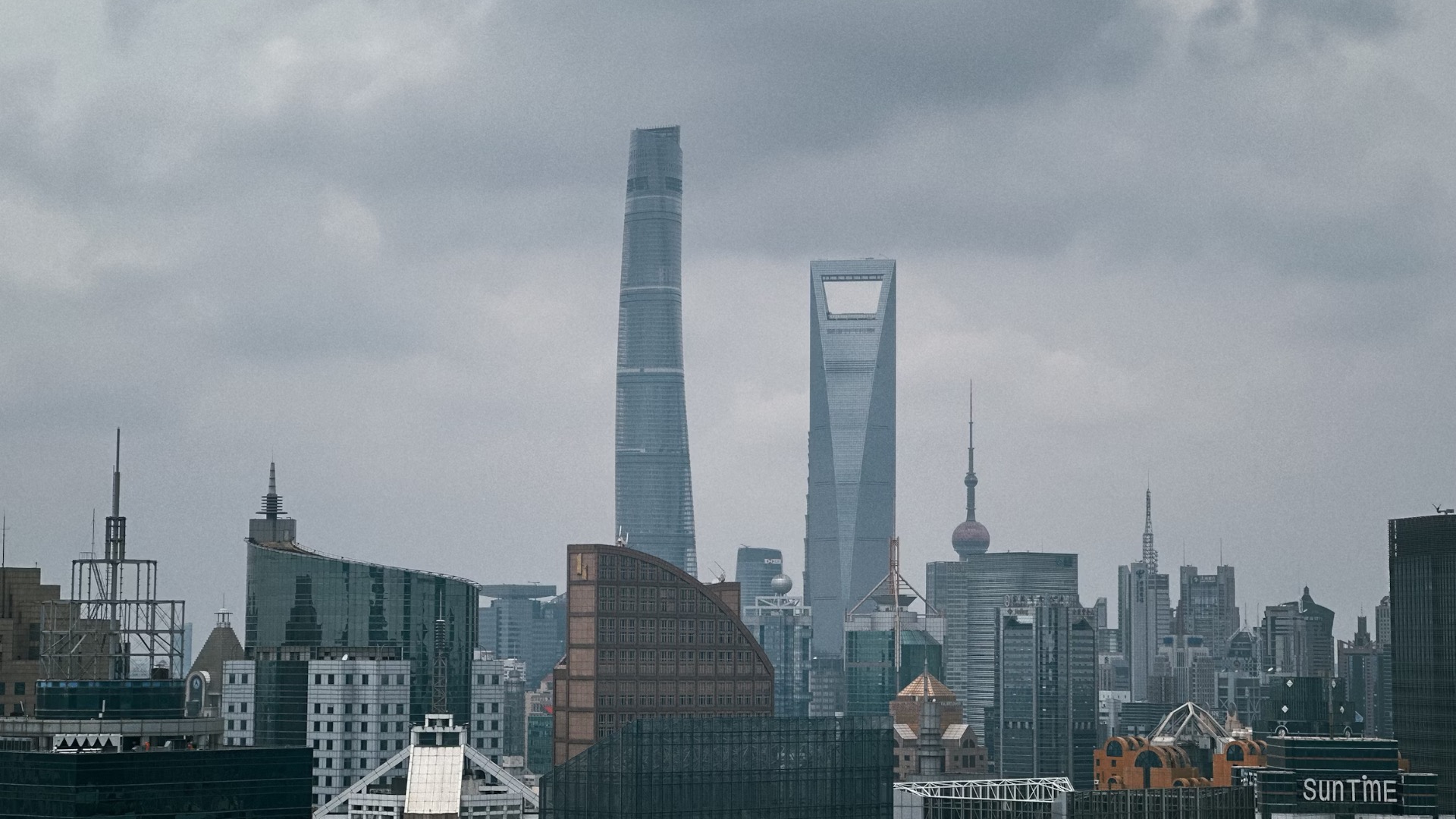

China's Economy at a Crossroads: Navigating Domestic Headwinds and a Shifting Global Landscape

After decades of global economic dominance and unprecedented growth, China’s economy has entered a challenging transition marked by significant domestic obstacles and a contentious international environment. Traditional drivers of growth face structural constraints, including a protracted real estate market correction and weakening consumer confidence. In addition, U.S. tariff escalations and growing friction with trading partners in the Global South cloud the outlook. These factors have raised doubts about China’s role as a central pillar of global supply networks. Moreover, major international organizations project a further slowdown in China’s economic growth, with the country’s policy decisions likely to impact both domestic development and the broader global economy.

Domestic Pressures: The Property Sector and Weak Consumption

One of major challenges faced by Chinese economy is the continuous and essential correction in its huge real estate market. After years of debt-fueled expansion, the sector is now a significant drag on economic activity. Real estate investments, housing starts, and sales have all continued to decline precipitously. In addition to developers, of whom an estimated 50% are currently experiencing solvency and viability issues, this downturn has put a strain on local government finances, which have historically depended significantly on property-related revenues. In addition to developers – approximately 50% of whom are currently facing solvency and viability challenges – this downturn has placed significant strain on local government finances, which have traditionally relied heavily on property-related revenues.

The ongoing real estate crisis has also undermined household wealth and confidence, contributing to persistent low private consumption. Nonetheless, the household savings rate remains elevated relative to pre-COVID-19 levels, reflecting sustained precautionary behavior. In response, the government has introduced measures to bolster domestic demand, including a ‚trade-in‘ program for consumer goods and initiatives to facilitate business equipment upgrades. To reduce households’ high savings, international organizations, especially the International Monetary Fund (IMF), have recommended rebalancing the economy by focusing more on consumption instead of investment, and by strengthening the social safety net.

The External Environment: A Contentious Trade Landscape

China’s external environment is one of increased protectionism and trade tensions. With Beijing retaliating with levies of up to 125% and the Trump administration threatening tariffs of up to 145% on all Chinese goods, the trade relationship with the United States remains deeply contentious. As a result, there is an increased uncertainty in the international trade policy. The Organization for Economic Co-operation and Development (OECD) projects that these tensions will cause global GDP growth to slow from 3.3% in 2024 to 2.9% in 2025.

The conflict extends beyond the United States. A ’second China shock‘ is underway, driven by a substantial increase in Chinese exports of ‚green‘ technologies such as batteries, solar panels, and electric vehicles (EVs). However, they are benefiting from extensive government subsidies. Although it has lowered the cost of certain goods, it has raised concerns in other countries, including Japan and EU member states, where businesses struggle to compete with China’s large, state-supported industries.

As a result, there has been a fundamental shift in China’s trade patterns. Facing tariffs from developed nations, China has become an increasingly significant source of supply for the Global South. However, this has led to widening trade surpluses with emerging economies, provoking frustration and a surge in hostile trade measures against China.

Economic Outlook and Projections

The recent economic data present a mixed picture. China’s economy demonstrated resilience in the first half of 2024 after experiencing 5.2% growth in 2023. However, the momentum is waning. According to OECD projections, GDP growth will slow down to 4.7% in 2025 and 4.3% in 2026. On the other hand, the World Bank offers an even more pessimistic forecast for 2025, projecting economic growth to slow to 4.0%, citing trade restrictions and weaknesses in the real estate sector. Over the medium term, the IMF projects that growth will gradually slow further to approximately 3.3% by 2029, reflecting structural challenges arising from a shrinking labor force and decelerating productivity.

Despite significant economic slack, inflation has remained low and is expected to rise gradually as the output gap narrows and the effects of declining commodity prices subside. This slowdown reflects not just cyclical headwinds but deep-seated structural challenges. The growth model that relied on high investment in infrastructure and housing is facing diminishing returns and has led to elevated debt levels among property developers and local governments. The government’s „new productive forces“ in high-tech manufacturing are unlikely to fully replace the drag from the property sector’s contraction in the medium term.

The Path Forward

In conclusion, China’s economy stands at a critical juncture, and its successful transition to a new growth model will require a comprehensive and balanced policy approach. Key measures include resolving challenges in the property sector through targeted government support, boosting domestic demand via expanded social protection, implementing structural reforms to enhance the service sector and foster private investment, and managing trade relations to reduce overcapacity and strengthen the multilateral trading system. The policy choices made in Beijing will not only shape China’s long-term economic trajectory but will also likely have profound and lasting implications for the global economy.

Sources Referenced:

- OECD Economic Outlook, Volume 2025 Issue 1: Tackling Uncertainty, Reviving Growth (June 2025)

- A Longer View: World Bank East Asia and the Pacific Economic Update (April 2025)

- The Contentious U.S.-China Trade Relationship (Council on Foreign Relations, April 2025)

- Will economic policy win China friends in the Global South? (Chatham House, September 2025)

- Vanguard economic and market outlook for 2025: Beyond the landing (Vanguard, December 2024)

- People’s Republic of China: 2024 Article IV Consultation (International Monetary Fund, August 2024)

The World in Focus: Highlights from Foreign Affairs’ Best Books of 2025

2025: A World Without Resolution

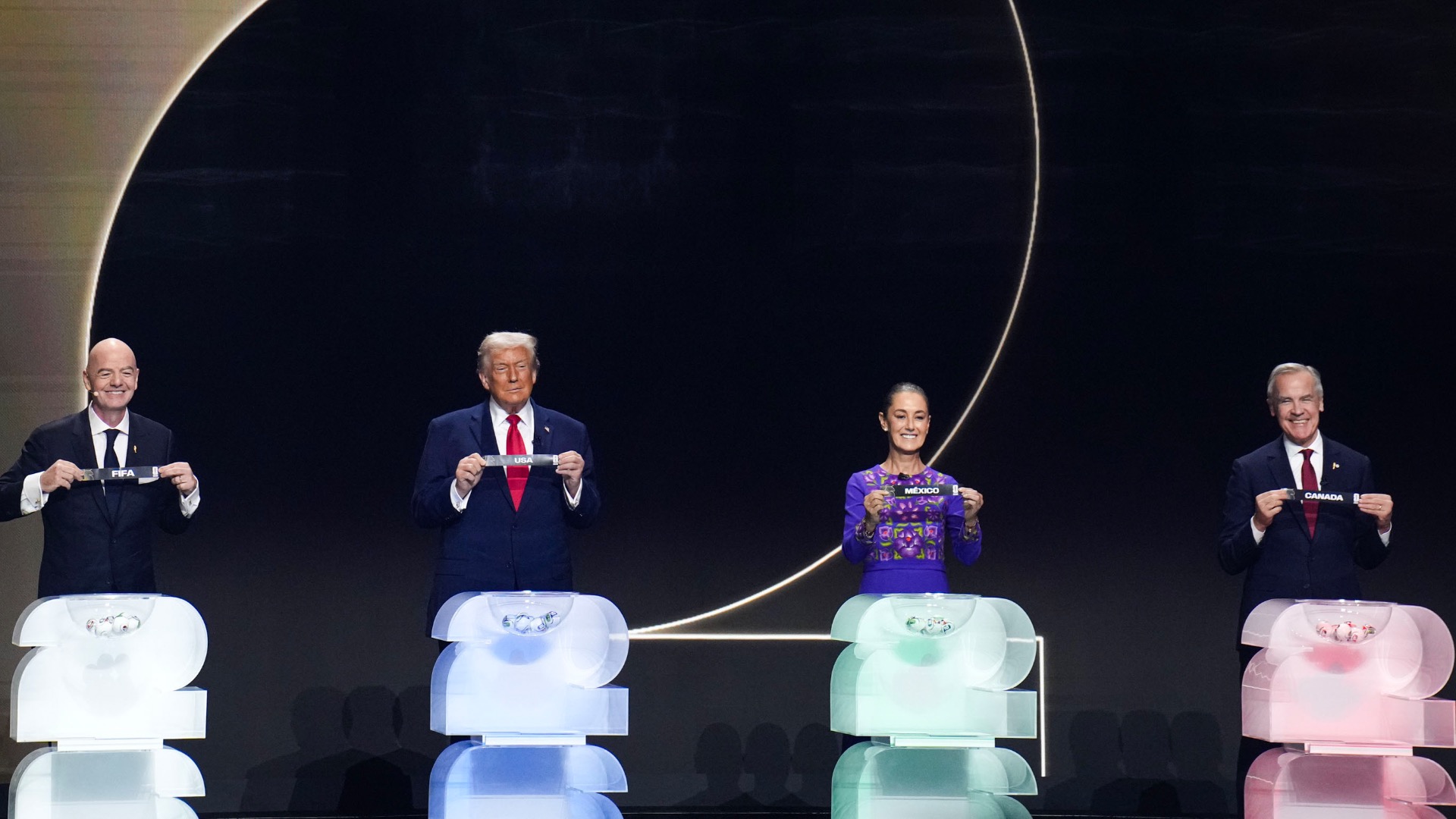

The U.S.-Venezuela Limited War of 2025: A Legal and Strategic Assessment